08.04.2022

Investment

Time to sell? What the 10-year deadline means – and how to make the most of it

Real estate is considered a long-term investment. Or is it? In most cases, yes. But by no means always: With massive price increases over the last few years, selling can be profitable – sometimes very hugely so. After all, prices per square meter in Berlin have more than doubled on average since 2011/12. A good basis for medium-term, perhaps even very short-term profits. If only there weren’t the speculation tax with its 10-year rule! But there are exceptions. And you should definitely know about them.

Which property from which district can be sold when and at what price? Is 10 years a long time? And what can owners do – sensibly – to shorten it? We’ll clarify the general conditions in a quick run-through.

Thinking of selling? More than reasonable given how the market is developing

10 percent annual returns – and that with classically low risk? Sounds like a great deal. A really great deal. In fact, that’s the average increase in Berlin real estate prices over the past twelve months. If you look at the last decade as a whole, the increases can be even bigger, depending on the type of property you are looking at. Price increases for owner-occupied apartments rank highest at an average of 140 percent. One- and two-family homes are in the golden mean of about 100 percent. However, residential and commercial buildings have also posted increases of 70 percent.

In all cases, it is possible to achieve healthy profits, especially when the investment volume is higher. Right now, it is well worth selling. After 10 years, the potential gains are particularly clear, and the same can also apply to medium- and short-term investment horizons. But are such shorter holding periods even possible in the real estate sector?

Beware of tax traps: Background to the 10-year time limit

Anyone who is thinking of selling their property in the near future should be aware of the legal situation – and think about the timing of any sale. Taxes play a major role. In other words: Germany’s infamous 10-year rule. If a property is bought and then sold again within this 10-year period, any transaction is deemed to be a taxable transaction. This can be expensive and significantly reduce your profits. For many investors, it is therefore worth waiting to sell until the 10-year period has expired – not before.

There is an understandable intention behind this speculation tax: The state wants to prevent real estate prices from being driven up by speculative trading. However, because speculative motives cannot be assumed to be behind every transaction, there are also exceptions. Owners with direct access to their property can even use the regulatory requirements to their advantage – as a real market advantage.

The speculation tax: When it applies – and when it doesn’t

In the standard scenario, taxes are incurred on sales concluded before the end of the 10-year period. The amount depends on two factors: the increase in value of the property and the seller’s personal income tax rate. The individual tax burden can therefore vary greatly – and has a major influence on whether a sale makes sense now or should be postponed.

For those who do not want to wait, there are two scenarios under the Income Tax Act in which any gains from the sale are tax-free – well before the 10 years expire. Everyone has to determine for themselves whether and how to use this option. However, it is essential that you occupy the residential property yourself – at least for a certain period of time.

Exceptional cases: How 10 years can become one, through personal use

The simple case first: If the apartment/home has been occupied entirely by the owner since its acquisition, it can be sold freely at any time. In this case, the 10-year period does not apply. However, even if you did not initially occupy the property yourself after purchasing it, there is a possibility:

This requires owners to have occupied the property for at least the last three calendar years. The period can therefore be radically shortened once again: As a rule, it is enough that the property was owner-occupied from the last day of the first year until the first day of the third year. So that’s only a little more than 12 months. However, you should have your precise options checked by a tax advisor in advance.

Potential sales proceeds: How location and property influence the sale

Anyone who bought a property in Berlin ten years ago – or less – can benefit from enormous increases in value when selling it now. The potential gains depend heavily on property type and location.

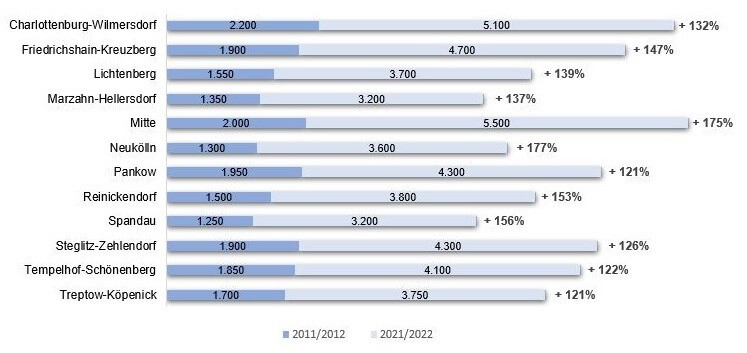

The greatest increases have been for existing condominiums. In Mitte and Neukölln, prices per square meter have almost tripled since 2011. And even in those districts with the lowest growth – Treptow-Köpenick, Tempelhof-Schöneberg and Pankow – they have risen by more than 120 percent. The highest selling prices can currently be achieved in Mitte, at an average of €5,500 per square meter. Close behind: Charlottenburg-Wilmersdorf.

Growth rates: Diverse, but buoyant overall

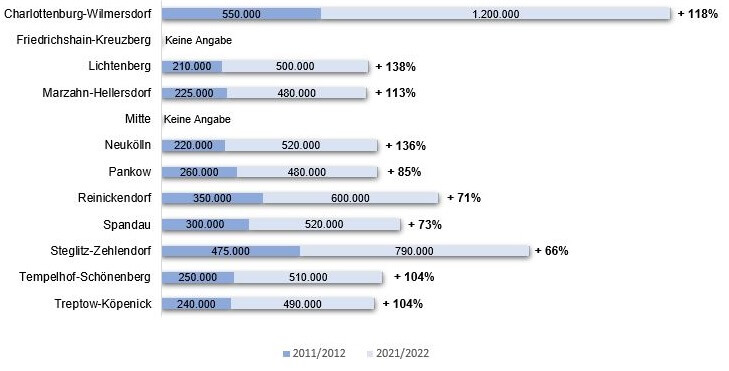

Sizeable profits can also be achieved on the market for one- and two-family homes if they are sold now. Here, median prices have doubled in the last 10 years. The spectrum is quite broad. It ranges from almost 140 percent in Lichtenberg and Neukölln to around 70 percent in Steglitz-Zehlendorf, Spandau and Reinickendorf. Marzahn-Hellersdorf and Charlottenburg-Wilmersdorf rank in the upper midfield with rises in excess of 110 percent. The latter is the absolute frontrunner with prices of over €1 million.

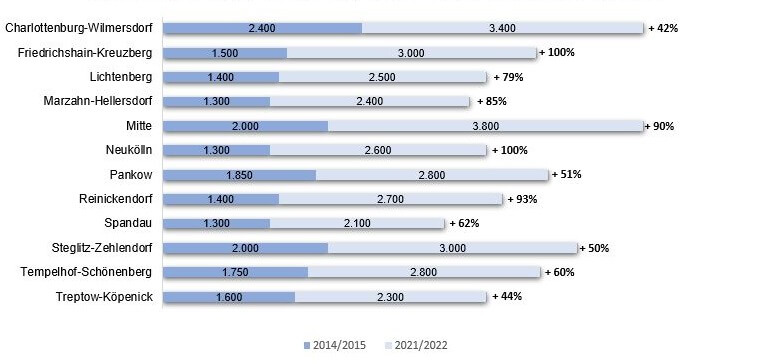

Potential returns on residential and commercial properties are not quite as impressive. But here, too, location is a key factor. Friedrichshain-Kreuzberg and Neukölln occupy the top spots with prices doubling, closely followed by Reinickendorf, Mitte and Marzahn-Hellersdorf.

Demand: Stronger and currently particularly high

Real estate prices in and around Berlin have been rising steadily for years. And the coronavirus pandemic provided yet another boost. Time and again, market observers have reported new price records. Recent developments have also been fueled by low interest rates, which are now slowly starting to climb again. But:

As a result of the current political situation, inward migration has already started to increase and experts are forecasting further population growth. This will once again drive up demand for residential real estate. Especially in uncertain and troubled times, people tend to invest in safe assets. And here (alongside government bonds and precious metals) real estate is way out in front. A sensible time to buy. And an even better time to sell.

Fast sale: Let us advise you!

David Borck Immobiliengesellschaft advises you on the sale of your real estate in Berlin and Brandenburg. We provide a free-of-charge valuation, review your options, and arrange tax experts to choose the optimal time for a sale. What’s more, we will market your property to the right audience. So that you can achieve the price that your property deserves.

Our experts will be happy to assist you. For general questions or individual consultations, you can reach us at any time on +49 (0) 30 887 742 50 or at service@david-borck.de.

Back

Back