23.09.2021

Investment

But at what price? Identifying the latest market opportunities and the optimal prices

How do you achieve the optimal price as quickly as possible? Quite simply, by knowing the value of the property and aligning its potential with recent developments on the market. What sounds so straightforward, however, is a complex process. Especially in a dynamic metropolis – and in turbulent times.

We shed light on the factors that drive the Berlin market, and look at their impact on the prices of condominiums, single- and multi-family homes. And we present methods that can be used not only to correctly assess potential returns, but also to maximize them.

The capital: a flourishing metropolis defies the crisis

So, just how attractive is Berlin today? In a word: extremely. The metropolis is not only the 6th most livable city in the world, it is also constantly evolving and constantly generating new potential – especially in the real estate market. This doesn’t always happen in a straight line, but there are certainly clear trends.

Although the net immigration rate has slowed since 2016, it is currently rising again and will continue to climb. According to a recent forecast from the Senate Department for Urban Development, the city’s population is expected to increase from 3.6 million today to around 4 million by 2030.

In relative terms, Berlin has grown faster than any other German city over the last 5 years, despite the slowdown.

Economic growth is also well above the national average – following a pause during the coronavirus crisis of 2020, growth is now back at 4% p.a.

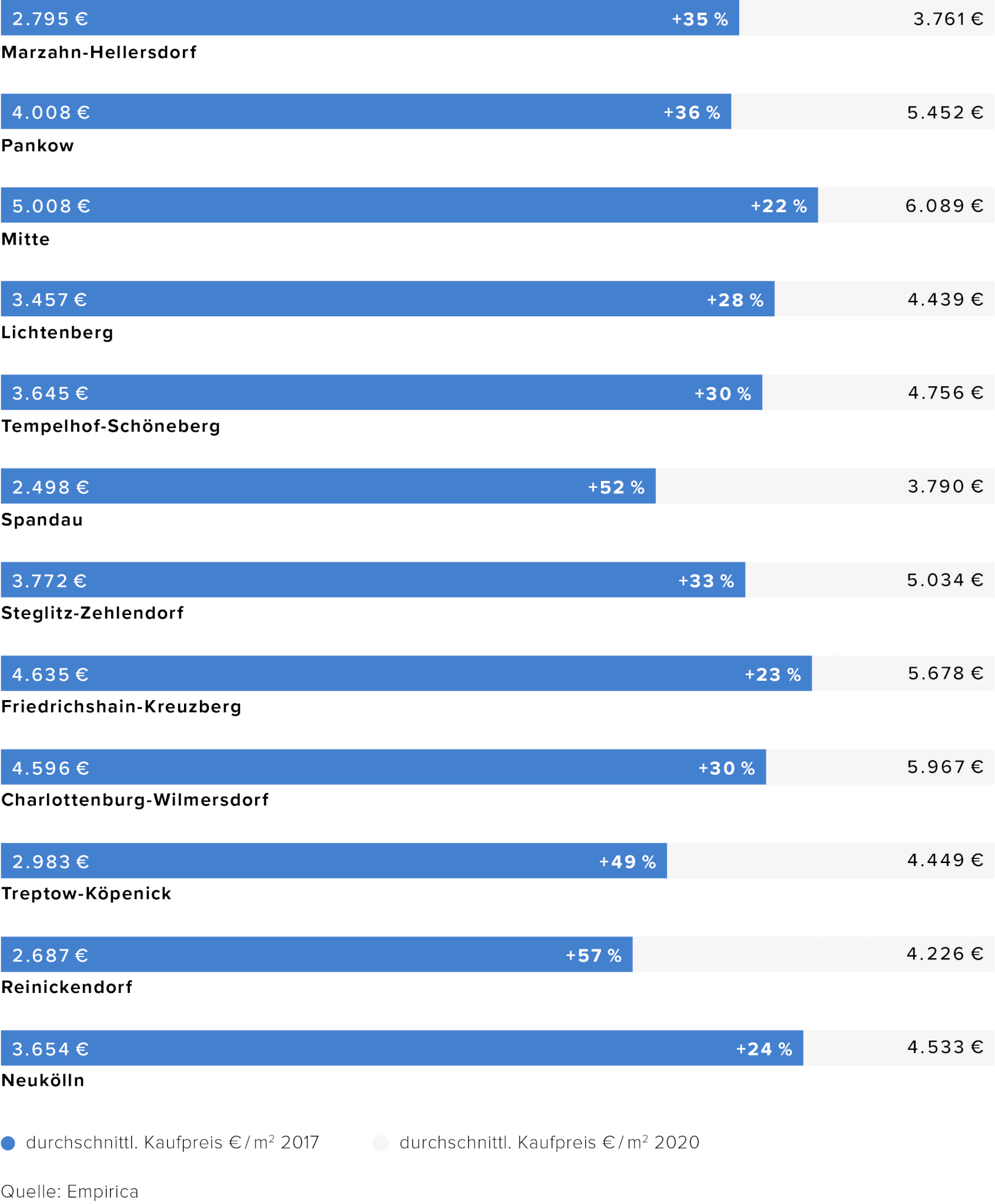

The development of purchase prices for condominiums with 2-4 rooms over the last four years in Berlin.

The Berlin market: dynamic and trending upward

Population and economic growth have combined to create a situation that presents major opportunities for sellers. As the number of private households continues to grow faster than the number of available housing units, demand far outstrips supply. Conservatively calculated, the current undersupply is equivalent to 68,000 housing units per year.

As a direct result of this housing shortage, prices for buy-to-let and owner-occupied properties have been rising sharply. Although the Berlin rent cap temporarily curbed investor demand for rental apartments, this was only the case in certain segments. Ever since the Federal Constitutional Court ruled the rent cap unconstitutional on March 25, 2021, the market has normalized and the signs are clearly pointing upwards in almost all areas.

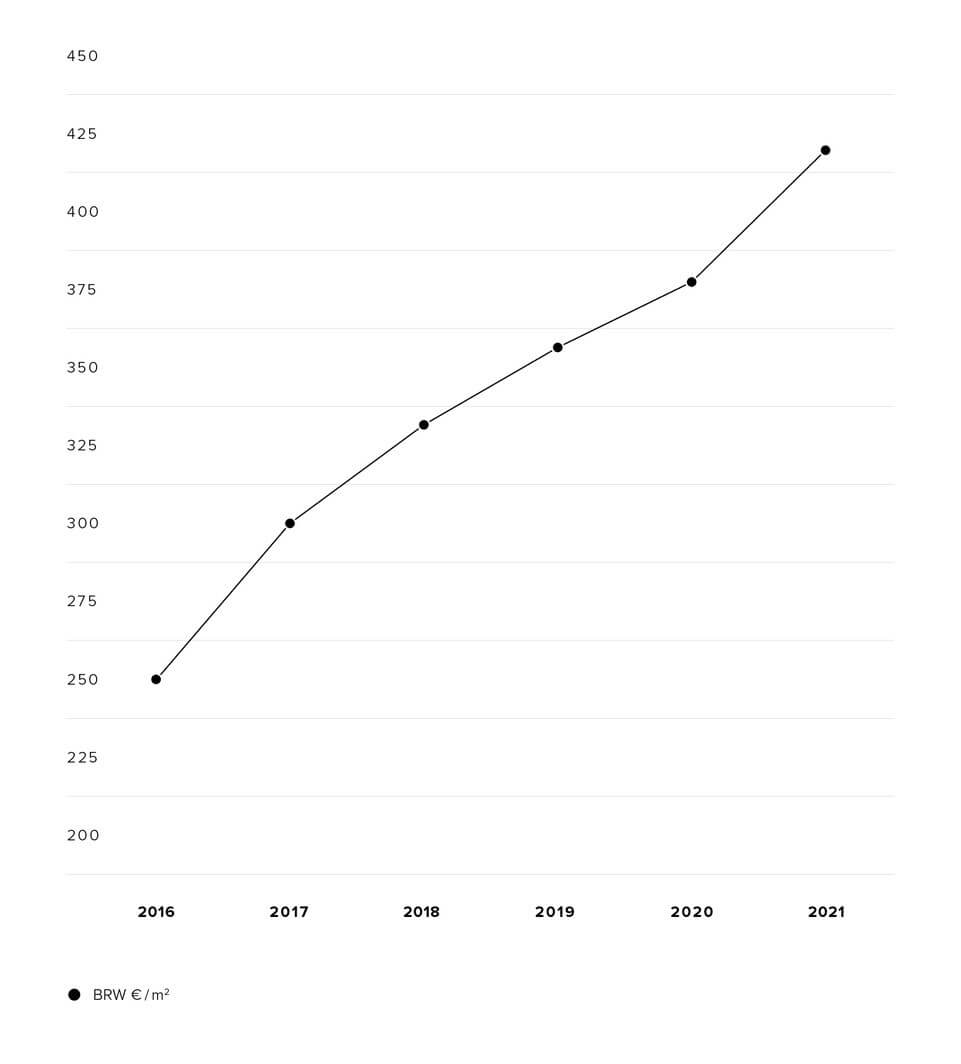

Standard land prices have also been consistently high for years. Overall, real estate prices in Berlin have now reached a level that no longer differs greatly from Germany’s highest-priced markets, Munich and Hamburg.

We have determined the development of the standard land value over the last four years in your location.

Expert Property Price Committee report: Prices rise for condominiums and single-family homes

Owners who are now looking to unlock the price potential of their properties would be well advised to consider at recent market developments. Based on actual sales contracts, Berlin’s Expert Property Price Committee has published a range of preliminary data for the Berlin housing market in 2021:

Compared with the previous year, condominium prices rose most sharply – by an impressive 13%. In the case of detached and semi-detached houses, the short-term increase was lower at 4%, but – viewed over the last four years – totaled 33%.

And the outlook? Well, according to the German Institute for Economic Research (DIW), the number of transactions is set to decline in the medium term. The reason: the scarcity of land available for new residential construction. And that, in turn, is driving sustained growth in the value of housing in Berlin.

Determining purchase prices: methods for realistic appraisals

Once you are aware of the market situation, you have the opportunity to take full advantage when you sell. To do this, however, it is important to have a clear understanding of a property’s basic value – and its potential. A professional valuation is indispensable:

Expert appraisals are based on both conventional indicators, including location, condition and price development, combined with the asset value method and an analysis of other properties on the market. At David Borck Immobiliengesellschaft we also use proprietary databases – and of course our own professional experience.

As we have done here in this blog post, we assess the market situation, consider recent developments and forecast the most likely future scenarios – political, demographic and economic. Focusing on the specific property, we analyze both value-related characteristics and the immediate surroundings – and weight both against more general market trends. In the case of residential and commercial properties, we also take into account rental conditions and lease terms.

The result is a well-defined purchase price range. To achieve the ideal price, all that’s left to do is astutely market the property. And that’s where our expertise really pays off.

Non-binding valuations: the best basis for the best price

When supply is short and prices are rising – as is currently the case – it generally makes sense to consider selling. How much value you can add to the final sale price, however, ultimately depends not only on the setting the right asking price, but also on getting your marketing right.

Anyone who wants to most effectively market their property can count on our support. At David Borck Immobiliengesellschaft, we specialize in the sale of residential real estate. With 30,000 active potential buyers in our database and state-of-the-art marketing strategies, we are committed to achieving the most profitable sale for you.

We broker your property quickly and transparently at the optimum price. Our experts are with you every step of the way you as dedicated, personal consultants throughout the entire sales process.

In addition, we would be delighted to provide you with a no-fee, no-obligation property valuation – at any time. A service you would be remiss not to take advantage.

You can find more information on our website: david-borck.de

Or call us directly at: +49 (0) 30 887 742 50

Your

David Borck Immobiliengesellschaft

Schlüterstraße 45 | 10707 Berlin | service@david-borck.de

Telefon +49 (0)30 887 742 50 | Telefax +49 (0)30 887 742 525

Back

Back