29.06.2019

Allgemein

Berlin is one of the frontrunners for real estate investments

Berlin in comparison with other European cities

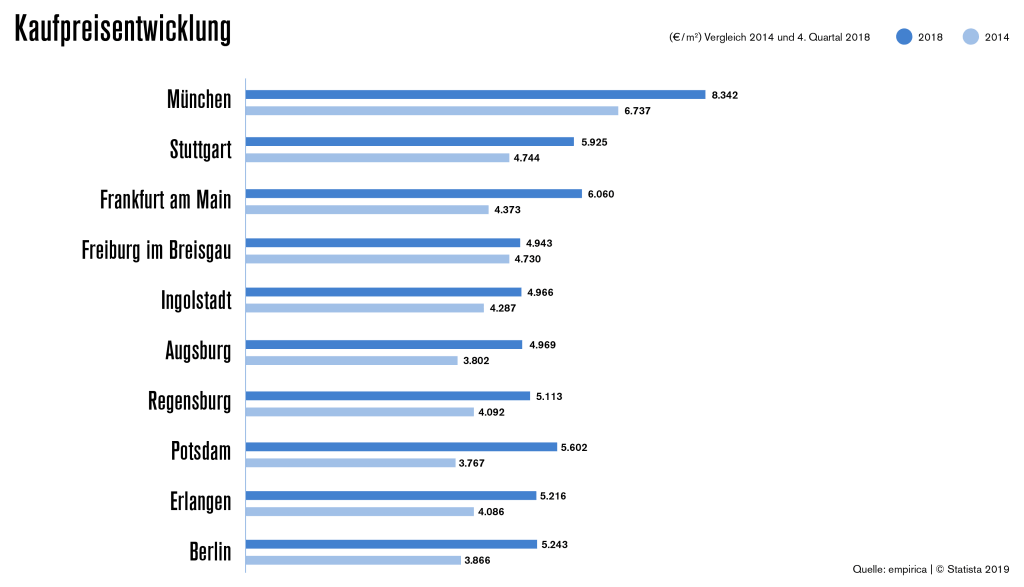

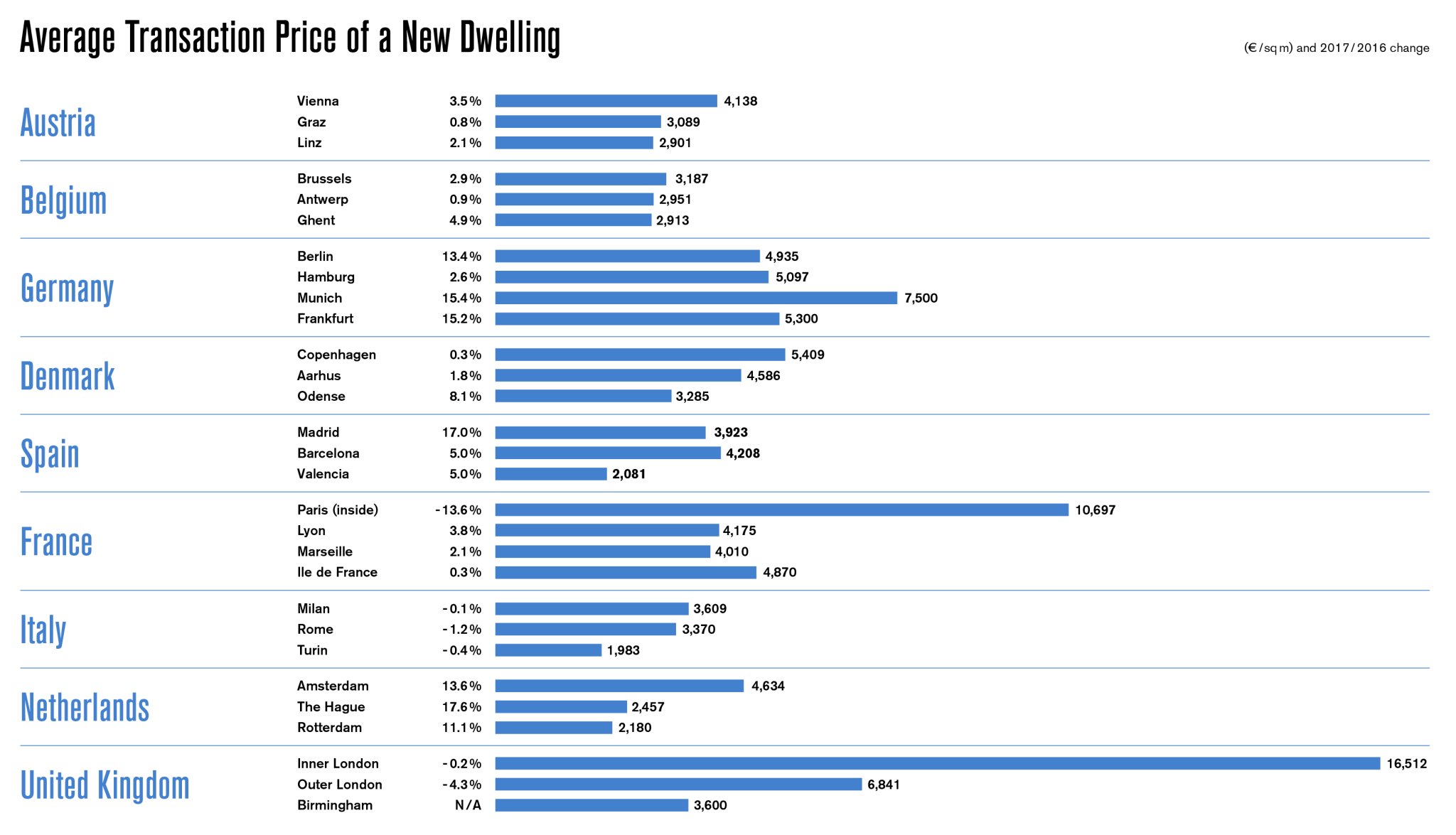

Real estate has never been so popular as a capital investment. And yet to this day, the value of a property is still primarily determined by one factor: its location! For the optimal investment it is therefore all the more worthwhile to thoroughly analyze the location of the target property. In addition to Hamburg, Munich and Frankfurt, Berlin is the undisputed favorite in the European ranking when it comes to investing in real estate. Although sales prices have more than doubled in recent years, the German capital is still regarded as the leader in terms of its investment potential. This applies to both new and existing properties. In contrast to other European metropolises such as London or Paris, Berlin can still score with comparatively low costs and particularly high growth potential. In addition, the German capital offers a stable economic environment. At the same time, high employment figures and the continuing influx of new residents make Berlin interesting for both national and international investors. This is also reflected in the investment volume for real estate. The Accentro Home Ownership Report, for example, shows a record turnover of 5.6 billion euros for the Berlin area in 2017. At that time, it was predicted that the figures would fall rapidly, but the boom is still continuing.

Buying is becoming more attractive than renting

This increase can be explained by the steadily rising rental prices, as paying off monthly instalments and becoming the owner of the residential property in the foreseeable future makes increasing sense for many tenants. At the same time, sellers hold enormous potential in their real estate assets, as they can also hope for a strong market in the outskirts of the city. In order to provide guidance for potential real estate sellers, David Borck Immobiliengesellschaft offers a free evaluation and personal consultation for each property. In order to get a fair price per square meter as a buyer, it is also worth taking a look at the city outskirts.

ABBA? ABBA!

As a start-up hotspot and due to its international appeal, Berlin also guarantees an enormous increase in the value of real estate in the future. Finding a suitable property, however, is becoming increasingly difficult, especially in the city center. In good locations, the German capital now has a clearly negative risk-return ratio. This phenomenon is now spreading even in selected suburban locations such as Kleinmachnow or Potsdam. Anyone who still wants to acquire real estate property in Berlin and the surrounding area should therefore proceed according to the ABBA principle: in A-cities, investments are made in B-locations, i.e. areas that tend to be cheaper, and in B-cities, investments are made in A-locations. The greatest potential in terms of returns is to be found in the north and east of the capital. This is where the gap between the recommended minimum return and the achievable return on equity is at its greatest.

Reverse Mortgage as alternative

Jutta Freiberg, expert for real estate annuities at David Borck Immobiliengesellschaft, recommends the Reverse Mortgage model if you want a more central location. Real estate owners sell their residential property but retain lifelong residential rights and receive the sales price either in installments, as a monthly pension, or in a lump sum. This model is particularly attractive for flexible real estate buyers who want a specific location, because they have the opportunity to acquire properties far below market value and profit from the increase in value. David Borck Immobiliengesellschaft specializes in the Reverse Mortgage model and is happy to assist interested parties in finding a suitable property.

Back

Back